About the client

Our client is a financial services company specializing in providing financing to small businesses across the US. With an average decision time of 2 business days, they operate in the high-risk lending segment. The client approached us to improve the underwriting process by integrating machine learning (ML) tools.

The client's requirements

The client needed to support and improve the CRM application used in the underwriting, reporting, and payment process. The main requirements for the team were:

- Collecting accurate and relevant data was one of the main requirements. We had to ensure the integration of several third-party applications to collect comprehensive information about the applicants' business, which would be processed by the ML model in one environment.

- Functional engineering: Selecting the most relevant features from the available data was crucial to building accurate ML models. We used advanced feature engineering techniques to extract meaningful insights from raw data.

- Model training and validation: Developing robust ML models requires a systematic approach to training and validating algorithms. We had to ensure that the models were constantly updated and validated to adapt to changing market dynamics.

Implemented a solution

The team's task was to create an automated system that could effectively assess the risks associated with loan applications and make informed decisions based on their information. The following solutions were implemented for this purpose:

Assessment of default risks: We developed three ML scoring systems that used historical data and 60 parameters to assess the risk associated with loan applications of 60 parameters such as state, business category, cash flow percentage, credit rating requests in the last 90 days, owner's FICO Score, and others. Using these parameters, the model categorized applications into different risk zones (low, low-moderate, moderate, moderate-high, high) based on various proposal parameters (duration, funding amount, percentage of capacity utilization, etc.), which allowed our client to make informed decisions based on predefined risk thresholds.

Data integration: We integrated 5 third-party tools to collect comprehensive information about the applicant's business. This integration provided a holistic view of the applicant's financial situation. All available information was parsed through these tools into a single source, which allowed ML models to make more accurate risk assessments.

Continuous model training: The models were retrained every three months using increasingly large amounts of data, with the most recent training involving 300,000 applications, 6,000 of which were approved. This continuous training ensured that the models remained relevant and adapted to market dynamics and the increase in review applications.

Results and benefits

- The integration of ML tools significantly reduced the underwriting processing time. The automated system could quickly assess the risk associated with loan applications, which helped speed up decision-making.

- ML scoring systems provide a more accurate risk assessment than traditional underwriting methods. The models could analyze various parameters and historical data, leading to better risk classification.

Conclusion

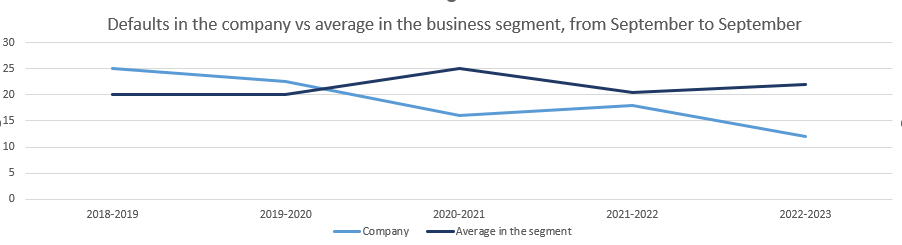

By integrating machine learning tools, our client achieved significant improvements in the underwriting process. ML scoring systems, data integration, and continuous model training have increased efficiency and compliance, and significantly reduced default rates. Our client now has a robust underwriting system that can make informed decisions based on comprehensive data analysis. Also, thanks to this solution, the company has significantly reduced the number of defaults that have occurred in the company since the introduction of the ML scoring model in 2020. Comparing the last year of 2022-2023 to September, the number of defaults in this business segment was 23%, while the client was only 13%.